binance tax forms reddit

However you have three options. Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain transactions settled on the exchange.

Pin En Cryptocurrency Latest News

The ownership of any investment decisions exclusively vests with.

. BinanceUS does not currently support ERC20 and BEP20 TRX deposits and withdrawals. Your tax forms will be ready soon. April 6 it will be fixed.

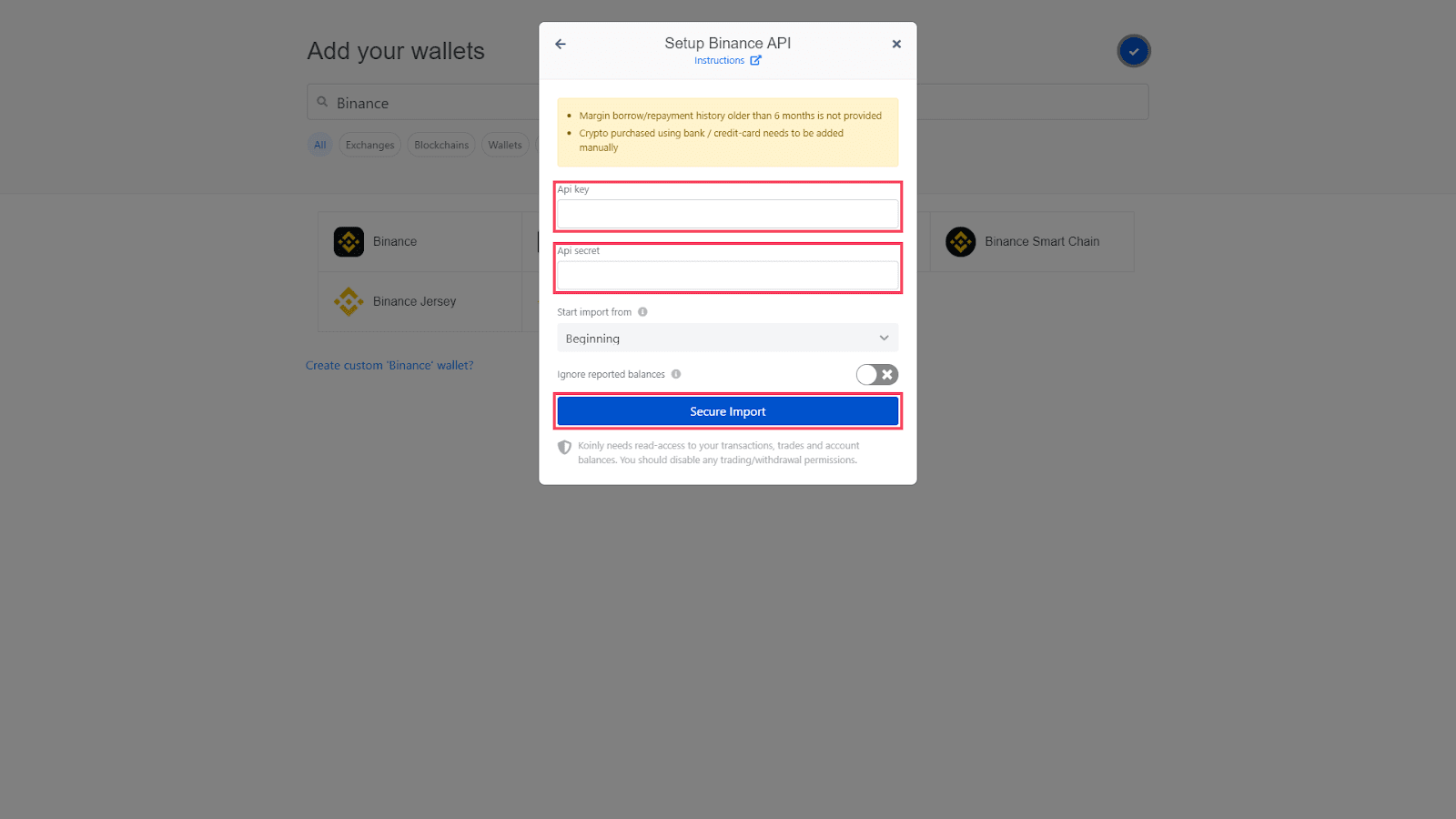

Click on Create Tax Report API. You can use a ZenLedger to combine your tax report. Click on the link to view your API key and secret and then click Edit and uncheck Enable Trading.

According to their website. Click Get code to receive a verification code to your email address. Please note that as generating records consumes server resources each user can only generate up to 6 times per month.

Binance is not endorsing any particular third-party tax tool software. Import your trade history onto a tool like bitcoin tax. Open the BinanceUS app and tap the User Profile icon on the bottom navigation bar.

Still that would be a lot more transactions. Here is a step by step procedure on how to get your tax info from Binance. If you do this through an exchange you better count on the IRS finding out.

Please exercise your own discretion andor consult your personal tax adviser based on your personal tax circumstances and requirements when selecting the third-party tax tools. Every crypto to crypto trade is a taxable event and this was the case before the new tax bill so be sure to include all trades from last tax season. Capital losses may entitle you to a reduction in your tax bill.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Depending on the countrys tax framework when you trade commodities and the event produces capital gains or losses you may have to pay taxes. Currently Cointracker doesnt support margin or futures reporting but it is in development.

BinanceUS is a fast and efficient marketplace providing access and trading for 75 digital assets. Especially when you are dealing in so many decimals of whole units and the fees are in a totally different currency from the actual trading pair. You will be emailed a link to confirm your API Key.

This goes for ALL gains and lossesregardless if they are material or not. Imagine if Binance establishes partnership with us and has this capability. It pulls your taxable events and populates a form to use during tax season.

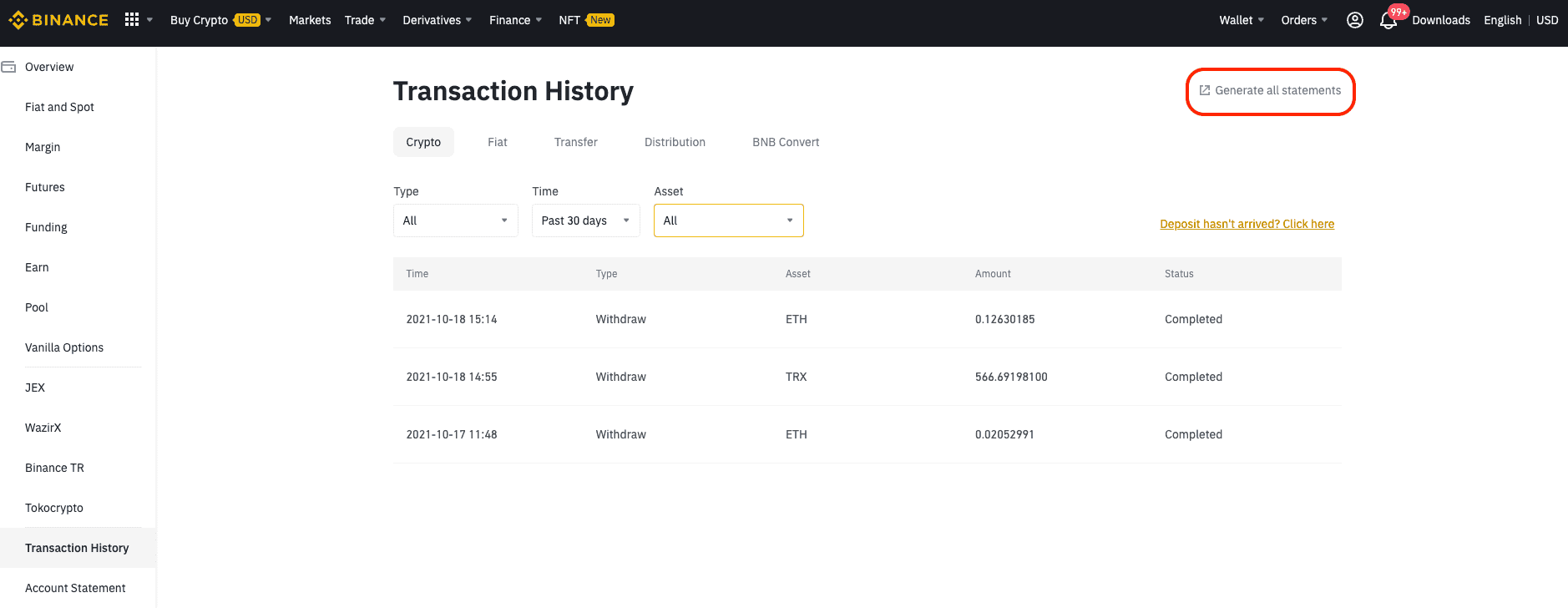

The API keys will automatically download your transaction history and keep your data in sync. Select the range account and coin you would like to display on the statement then click Generate. Users can access the Tax Reporting Tool via Account API Management.

Log in to your Binance account and click Wallet - Transaction History. Scroll down and tap Tax Statements. Crypto back to USD yes.

Log in to your CoinTracker account. For your Tax Report youll receive a unique API and Secret Key. What do you guys think if Binance can offer tax forms directly to its customers without asking tax ID details and freaking them out.

Copy and paste your keys here. Created Sep 17 2019. BinanceUS Crypto GainLoss import is temporarily unavailable.

Binance will be launching the Tax Reporting Tool at 2021-07-28 0400 AM UTC a new API tool to allow Binance users to easily keep track of their crypto activities in order to ensure they are fulfilling the reporting requirements laid out by their regulatory bodies. Go to the Binance API page by hovering over the user icon in the top header and then click API Management. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct.

I am not an accountant. Click Generate all statements. BinanceUS makes it easy to review your transaction history.

Name your API Key and click Create New Key button. How to generate your Tax API Key on iOS or Android. Carefully review the on-screen information then tap Generate Tax API.

As it stands right now crypto is an asset especially if youre using it to make profits. The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. Wait until April 6 when BinanceUS Crypto GainLoss import is expected to be available again Enter the information manually Is this true.

We will continue evaluating coins tokens and trading pairs to offer on BinanceUS in accordance with our Digital Asset Risk Assessment Framework community feedback and market demand. Crypto to crypto in the US is a taxable event. BinanceUS does NOT provide investment legal or tax advice in any manner or form.

Binance US Tax Reporting You can generate your gains losses and income tax reports from your Binance US investing activity by connecting your account with CoinLedger. No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Once you have your Tax API Keys complete the steps outlined below.

Scroll down and tap Tax Statements. Now choose Create Tax Report API. How to generate your Tax API Key on iOS or Android.

Click here to add your BinanceUS Tax API Key and Secret Key to CoinTracker. Copy the API Key and Secret Key to. BinanceUS shall not be liable for any consequences thereof.

Buying goods and services with crypto. File these crypto tax forms yourself send them to your tax professional or import them into your preferred tax filing software like TurboTax or TaxAct. Sign in to BinanceUS API Management.

Firstly click on Account - API Management after logging into your Binance account. Enter the verification code and your 2FA code if required then click Submit. Open the BinanceUS app and tap the User Profile icon on the bottom navigation bar.

The guide and accompanying screenshots are only an illustration. Thats like 3 different symbol for one trade. Under Tax Statement Methods tap Tax API.

We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Binance Tax Reporting You can generate your gains losses and income tax reports from your Binance investing activity by connecting your account with CoinLedger. If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability.

To connect your BinanceUS account to CoinTracker youll first need to Generate your Tax API Key on BinanceUS. Binance does not provide tax or financial advice. Under Tax Statement Methods tap Tax API.

BinanceUS does NOT provide investment legal or tax advice in any manner or form. Do not send ERC20 and BEP20 TRX tokens to your BinanceUS wallet.

How To Prepare Your Crypto Taxes Bittrex Exchange

New Upgraded Tax Reporting Tool R Binanceus

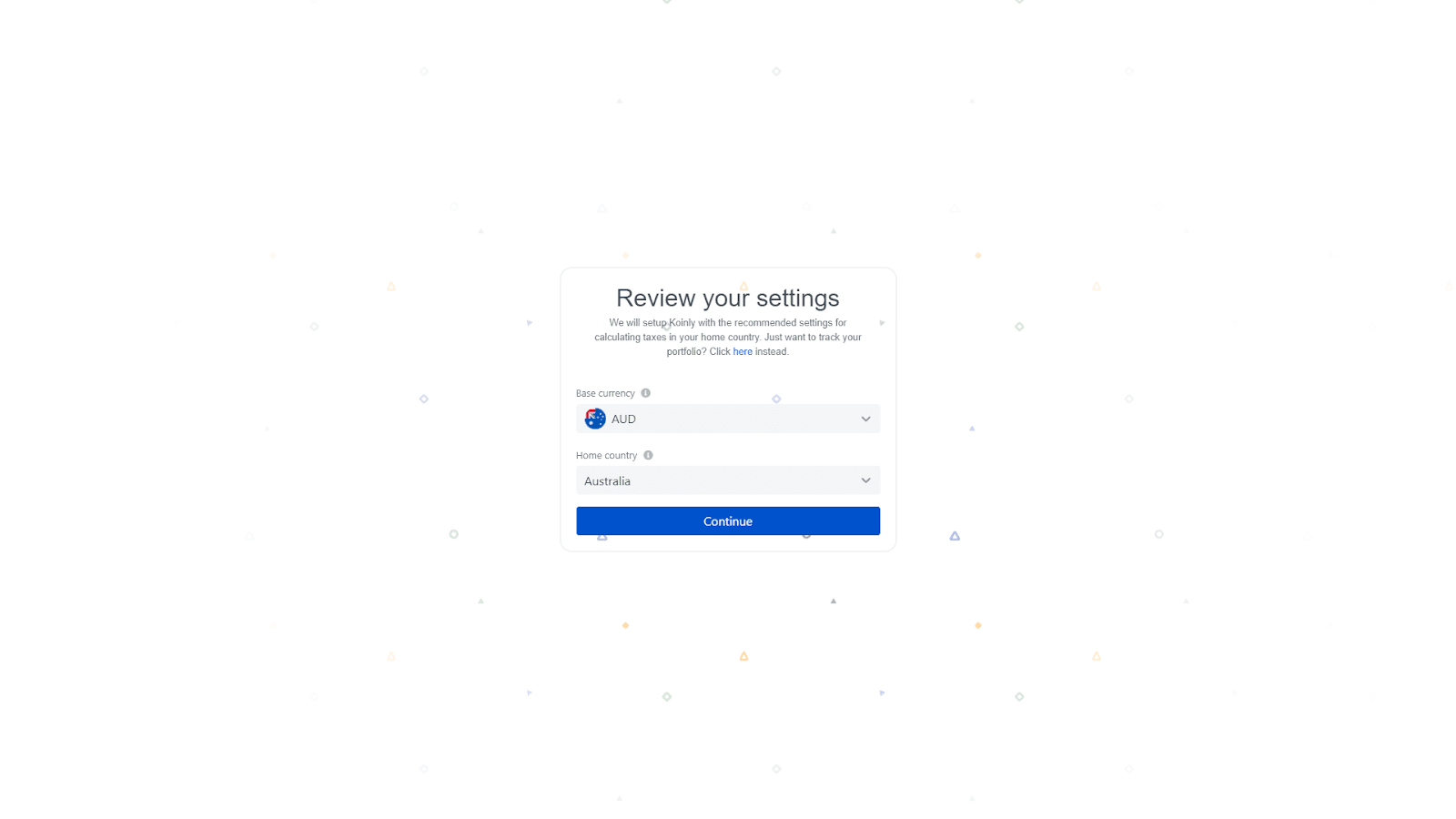

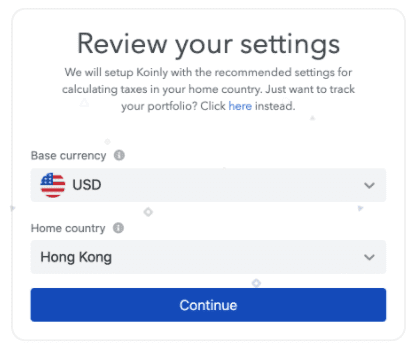

The Complete Pancakeswap Taxes Guide Koinly

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

Ireland Cryptocurrency Tax Guide 2021 Koinly

Does Binance Us Report To The Irs

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support

Does Binance Us Report To The Irs

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

3 Steps To Calculate Binance Taxes 2022 Updated

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Obtain Tax Reporting On Binance Australia Frequently Asked Questions Binance Support